- Invisible Rules

- Posts

- 1 Brutal Truth About the $5M Ceiling

1 Brutal Truth About the $5M Ceiling

Why Your Sales Strategy Could Be Killing Your Exit

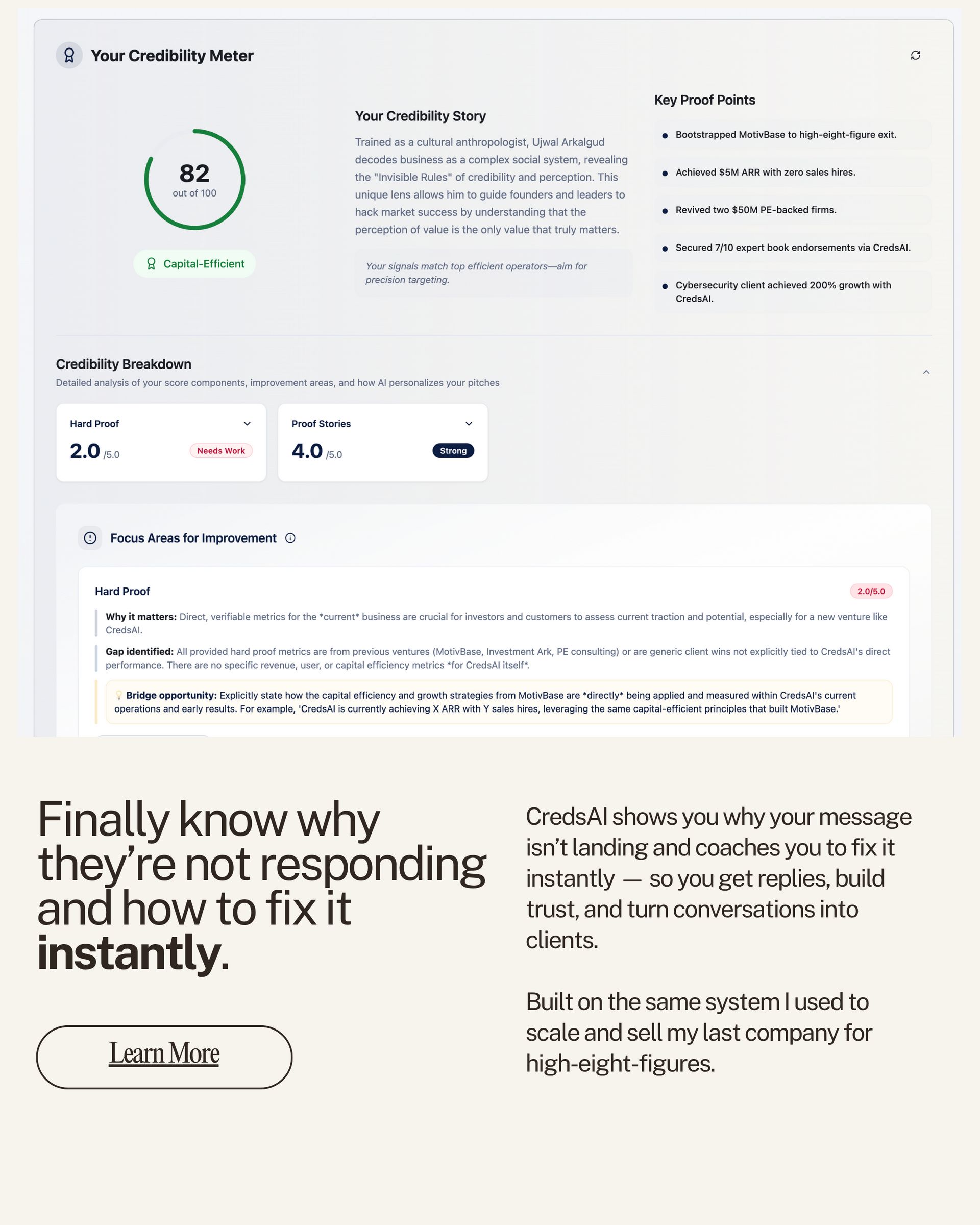

TLDR; You aren’t failing at sales; you’ve just run out of "Crazy People." Most B2B founders hit a glass ceiling between $3M and $5M because the self-selecting audience of innovators is exhausted. To break through, you must stop being the Innovative Solution and start being the Inevitable Solution. Today, we’re decoding the invisible psychological barriers of the mid-market and showing you how to pivot from Attention-based tactics to Trust-based dominance.

In this issue, we’ll tackle:

The Early Adopter Mirage: Why your first $3-5M was actually the "easy" part.

The CYA Psychology: Decoding the self-protection barriers of the broader market.

Innovative vs. Inevitable: The high-stakes shift in brand positioning.

Let’s dive right in.

The Death Zone: $3M to $5M

I recently spoke with a founder doing just under $5M in ARR. On paper, they’re winning. In reality, they’re panicking. Their Customer Acquisition Cost (CAC) has spiked 40% in six months, their sales cycle has doubled, and their team is exhausted.

They think the product is breaking. It isn’t. They think the market is cooling. It isn't.

What they don’t realize is that they’ve hit the Psychological Crisis Point.

In your first $3M—for some, it’s $5M—the market does the heavy lifting for you. You attract the innovators. These are buyers who are empowered, risk-tolerant, and actively searching for an edge. They aren't afraid for their jobs; they’re afraid of being obsolete. Selling to them is an Attention-based game. If you have a cool enough trigger, they’ll jump.

But then, the crazy people run out.

Suddenly, you’re staring at the Early Majority. These people aren't looking for an edge; they’re looking for Safety. They don't care if your AI is 10x faster; they care if implementing it will get them fired if it glitches.

The Invisible Rule of “CYA” (Cover Your Ass)

As an anthropologist, I look at the B2B sales floor as a tribal ecosystem governed by fear. When you move beyond the $5M mark, you are no longer selling to individuals; you are selling to Consensus Machines.

In this broader market, the Invisible Rules shift:

Validation > Innovation: The buyer’s primary goal is self-protection.

Consensus = Security: If five people sign off on a bad decision, no one gets fired. If one person signs off on a bold decision that fails, they’re gone.

The Promotion Metric: Every decision-maker is asking, "Will this help me get promoted, or will it make my life harder?"

If you keep using your Attention Triggers, the flashy features and the disruptive language, on these buyers, you will fail. You are triggering their danger response, not their curiosity response. You are paying a Performance Tax by trying to force an old playbook onto a new psychological reality.

From Innovative to Inevitable

The biggest mistake I see stuck founders make is leaning harder into being innovative. They add more features. They make the branding louder.

A founder who understands these invisible rules does the opposite. They pivot from being the Innovative Choice to being the Inevitable Choice.

Innovative says: "We are the new, cool way to do X." (This screams Risk to a mid-market Director).

Inevitable says: "This is how the industry is moving, and everyone else is already on board. If you don't do this, you'll be the only one left behind." (This screams Safety).

You move from Attention-based tactics (look at me!) to Trust-based tactics (look at the industry). You stop selling the tool and start selling the transition.

Action Plan: How to Break the ~$5M Ceiling

If your growth has flatlined, your Growth Potential in an M&A exit is currently zero. Buyers don't buy flatlines. You need to restart the engine by decoding the human layer.

1. Run the Junior Circuit Strategy on Your Non-Closers Stop asking the VP why they didn't buy. They'll give you a "logical" excuse about budget. Instead, go to the subordinates. Ask: "What's the one thing your boss is worried about failing at this year?" That is your Shadow Constraint. If they’re worried about data security, stop talking about speed and start talking about compliance frameworks.

2. Shift Your Language from Features to Expectations Use the Investment Triggers framework. In your demos, stop showing the dashboard. Start saying: "Usually, when companies your size move to this model, the expectation from the C-suite is that you'll see a 20% reduction in manual oversight. We’ve built the implementation to ensure you hit that milestone by Q3." You are now selling their promotion, not your software.

3. Manufacture Inevitable Social Proof If you have 50 small clients, the mid-market doesn't care. They want to see someone exactly like them who survived the transition. Create a Consensus Kit—a packet of data, testimonials, and implementation roadmaps that your champion can literally copy-paste into an internal email to their boss. Make it impossible for them to fail.

The Cost of Doing Nothing

If you stay stuck at $5M for two years, you aren't just flat. You are Negative Success. A potential acquirer will see a business that has found its level and will consider you a risky or low-value investment.

Breaking the ceiling requires the courage to stop being the scrappy startup and start being the Industry Standard. It’s an anthropological shift in identity.

Provocative Question for You: Look at your last 5 lost deals. Was it actually a budget issue, or did you fail to provide enough safety for the buyer to risk their reputation on you? Are you still trying to be the cool choice in a room full of people who just want to not get fired?

Hit reply and tell me your ceiling. Are you at $3M? $5M? Let’s decode your specific psychological wall.

P.S. My book, Invisible Rules: How to Outsmart the Entrepreneurial Game, is available for pre-order in March. It’s for founders who are tired of the “just scale faster” advice and want to understand the actual social mechanics of the game.

Keep Reading

Reply